In the wake of Donald Trump’s presidential victory, investor optimism has surged throughout the cryptocurrency market, driving notable good points in main crypto-related stocks.

Shares of Coinbase Global (NASDAQ: COIN) and Robinhood Markets (NASDAQ: HOOD) have skilled important good points, pushed by renewed bullish sentiment surrounding digital belongings.

With Trump’s pro-crypto stance and the Republican Party regaining management of the Senate, buyers are more and more looking forward to supportive insurance policies that would additional increase the valuations of those stocks, solidifying their positions inside a quickly evolving market.

Coinbase (NASDAQ: COIN) inventory

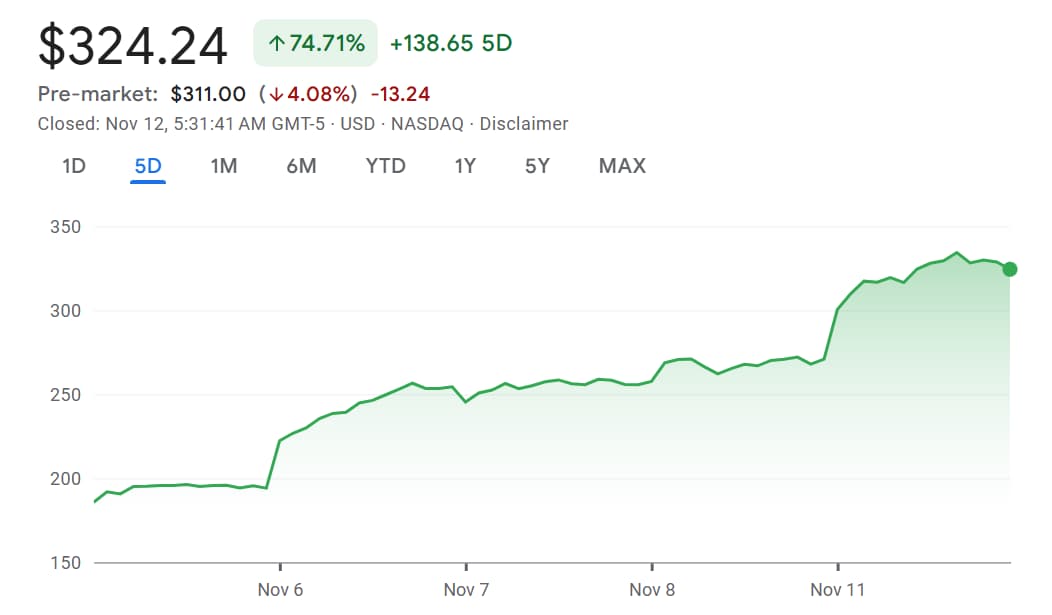

Coinbase has surged as a distinguished benefactor of the post-election crypto rally. The inventory gained a formidable 19.7% on Monday, reaching $324, marking its first time above the $300 mark since 2021.

Currently buying and selling at $324.24, the inventory boasts a month-to-month acquire of 65% and a year-to-date acquire of 106%.

With Bitcoin surpassing $80,000, Coinbase stands to benefit from heightened buying and selling volumes and elevated investor curiosity.

As a number one cryptocurrency exchange, Coinbase reported Q3 2024 income of $1.2 billion with a web earnings of $75 million, marking seven consecutive quarters of optimistic EBITDA. While complete income decreased 17% quarter-over-quarter, Coinbase noticed transaction development from stablecoin integration and enhancements to its Base community.

Coinbase’s strategic positioning as a custodian for practically all spot Bitcoin ETFs, together with BlackRock’s (NYSE: BLK), exhibits its potential to benefit from elevated institutional adoption. This increasing attain offers Coinbase a aggressive edge in attracting institutional and retail investments, particularly as Trump goals to make the U.S. the “Crypto Capital.”

Analysts are largely optimistic, with Barclays lately elevating its worth goal on Coinbase to $204, in accordance to TipRanks, reflecting optimism concerning the potential influence of pro-crypto insurance policies.

Robinhood Markets (NASDAQ: HOOD) inventory

Robinhood has successfully tapped into the current surge in crypto optimism, with its shares reaching a brand new 52-week excessive of $33, marking a formidable 40% acquire since early November.

This momentum displays robust investor confidence, fueled by Donald Trump’s election victory, which propelled Bitcoin to an all-time excessive and sparked renewed curiosity in crypto-related stocks.

The platform’s numerous choices, together with plans to increase into futures buying and selling for Bitcoin and Ether as reported by Yahoo Finance, together with worldwide growth initiatives, place Robinhood properly to seize elevated buying and selling exercise.

For occasion, Robinhood’s cryptocurrency revenues reached $268 million within the first three quarters of 2024.

(*2*)

Currently buying and selling at $32.80, Robinhood has posted a five-day acquire of 33% and a year-to-date acquire of 165%. The firm’s diversification technique consists of its deliberate acquisition of Bitstamp, a transfer that may improve its product lineup and lengthen its worldwide market attain, significantly in Europe and Asia.

Nonetheless, Robinhood continues to face regulatory challenges within the U.S., together with a current $3.9 million settlement with the California Department of Justice and a Wells discover from the SEC in May.

Despite these headwinds, Robinhood’s elevated buying and selling exercise is clear in its rising belongings below custody (AUC), which reached $159.7 billion on the finish of October, up 5% from September 2024 and a formidable 89% year-over-year, demonstrating strong efficiency within the present market surroundings.

With Trump’s election win, buyers are looking forward to regulatory stability, which may alleviate a few of these headwinds and supply a extra supportive surroundings for the crypto sector total.

As Bitcoin reaches new highs, these two stocks stand out as prime alternatives within the evolving crypto panorama, with robust development outlooks fueled by each market momentum and anticipated regulatory readability.

Featured picture by way of Shutterstock