Core Scientific (NASDAQ: CORZ), one of many publicly listed Bitcoin miners from Wall Street, reported a decline in BTC manufacturing for November, aligning with a broader business pattern. The firm continues to pursue its strategic growth plans in Texas, in response to the month-to-month operational replace launched at this time (Thursday).

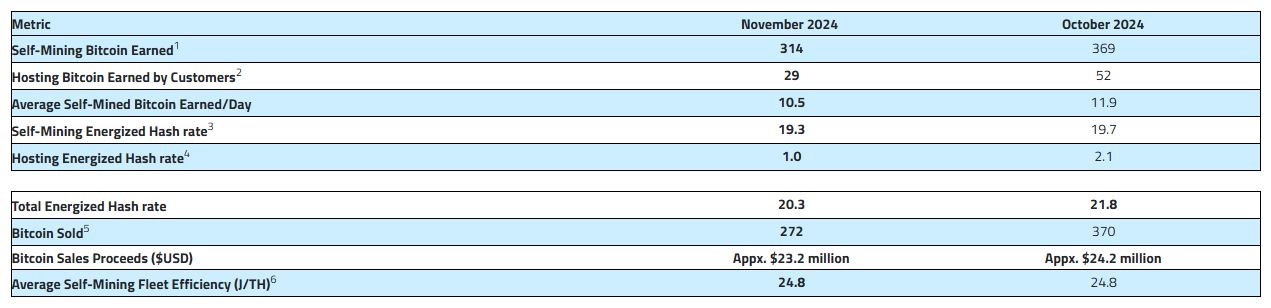

The blockchain infrastructure firm, one of many greatest Wall Street BTC firms primarily based available on the market cap, mined 314 Bitcoin in November, marking a 14.9% lower from October’s 369 Bitcoin. Daily manufacturing averaged 10.5 Bitcoin, in comparison with 11.9 in the earlier month, whereas sustaining a self-mining fleet effectivity of 24.8 J/TH.

Although Bitcoin reached document highs in November, nearing the $100,000 mark, the rise in mining issue led to decrease manufacturing by miners. However, they nonetheless earned roughly 25% greater than in October.

Among different main Wall Street-listed miners, outcomes additionally declined. CleanSpark (NASDAQ: CLSK) produced 622 BTC, whereas Riot Platforms (NASDAQ: RIOT) adopted with 495 BTC. Bitfarms (NASDAQ: BITF) and Cipher Mining (NASDAQ: CIFR) reported comparable outputs of 204 and 202 BTC respectively, highlighting the extreme competitors in the mid-tier phase. TeraWulf (NASDAQ: WULF) accomplished the group with 115 BTC mined through the month.

MARA Holdings (NASDAQ: MARA), the biggest publicly listed cryptocurrency mining firm, was the one one to achieved a greater Bitcoin manufacturing, rising its output by 26% to 907 BTC in November.

Moving again to Core Scientific, the corporate’s whole energized hash fee stood at 20.3 EH/s by month-end, working roughly 172,000 Bitcoin miners throughout its amenities. Self-mining operations accounted for 19.3 EH/s, representing about 96% of the corporate’s whole mining capability.

More Details from Core Scientific

Core Scientific secured approval from the Denton City Council to increase its Texas operations, rising its energy allocation to 394 MW. This growth aligns with the corporate’s broader technique so as to add 300 MW of essential IT load throughout present amenities.

The internet hosting providers phase confirmed decreased exercise, with customer-owned miners incomes an estimated 29 Bitcoin in November, down from 52 in October. The firm at the moment hosts roughly 7,200 customer-owned miners, representing 4% of whole operations.

Financial operations remained steady, with Bitcoin gross sales producing roughly $23.2 million in proceeds from 272 Bitcoin offered throughout November. The firm continued its dedication to grid stability, contributing 23,309 megawatt hours to native electrical grids via strategic energy consumption administration.