Shiba Inu (SHIB) has shaped a bull flag sample. This suggests a attainable 48% value enhance quickly. The SHIB value prediction appears robust because the token trades at $0.00002413. It has gained 133.54% for the reason that begin of 2024. The Shiba Inu bull flag sample matches earlier profitable rallies and signifies rising market confidence.

Can Shiba Inu Repeat History? 1.6 Trillion SHIB Exiting Exchanges Could Fuel a 48% Surge

Technical Analysis Points to Bullish Breakout

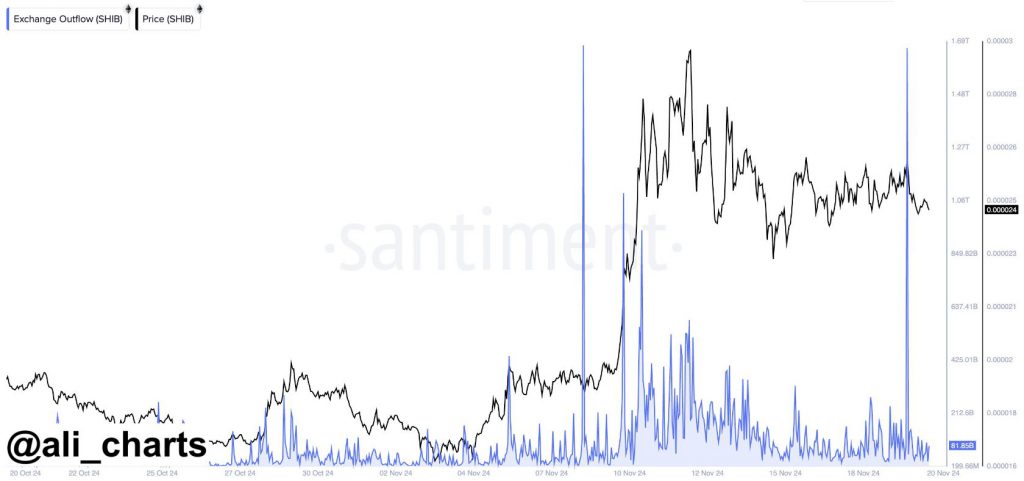

Crypto analyst Ali Martinez noticed a bull flag sample on November 21, 2024 (@ali_charts). It began forming after SHIB rose 60% between November 4-11. The value hit $0.00002921 throughout that interval. Now, the sample suggests a goal of $0.000037. This would imply a 48% rise from present costs. The Shiba Inu sample follows normal technical guidelines, making the bullish case stronger. Market quantity helps this potential breakout state of affairs.

Exchange Withdrawals Signal Strong Holder Sentiment

Martinez reported that 1.67 trillion SHIB left exchanges on November 20, 2024. This occurred in simply 24 hours. An analogous transfer final 12 months led to a 62% value bounce. Less SHIB on exchanges usually pushes costs up when consumers step in. This helps the SHIB value prediction for main features forward. The withdrawal sample reveals rising confidence amongst long-term holders.

Market Position and Ecosystem Growth

SHIB is now the eleventh largest cryptocurrency. It’s grown past simply being a meme coin. The mission now has DeFi apps, a stablecoin, and Shibarium for scaling. This month alone, it gained 32.10%. The broader crypto market power helps, too. These developments strengthen SHIB’s market place considerably.

Historical Pattern Recognition

The present bull flag appears like previous patterns that led to cost jumps. Holders moved 1.6 trillion SHIB to non-public wallets. This modifications provide and demand in a means that would enhance costs. The mission’s development and technical indicators match previous intervals of massive value strikes. These components help the anticipated 48% surge. Trading volumes and market sentiment align with earlier bullish breakouts.