The crypto market has seen a shift in energy, with Binance rising as a dominant participant in the worldwide exchange community.

Despite challenges like regulatory scrutiny and market volatility, Binance has solidified its place, capturing an growing share of the Bitcoin reserve market amongst Proof-of-Reserve (PoR) exchanges.

Binance’s Bitcoin Reserve Market Share Grows Since 2017

Data from CryptoQuant founder Ki Young Ju highlights Binance’s progress from mid-2017 to late 2024. Starting with a small share in 2017, Binance expanded quickly, reaching about 10% of the market share by early 2018.

After a decline section from 2018 to 2020, the exchange started to extend its dominance in 2021, coinciding with a surge in international crypto-asset adoption.

From mid-2021 onward, Binance’s market share steadily climbed, surpassing 40% in 2024. This progress displays its capability to draw customers by means of broad liquidity, an increasing consumer base, and aggressive providers.

Binance’s rise additionally occurred throughout intense market competitors and heightened demand for clear reserve administration.

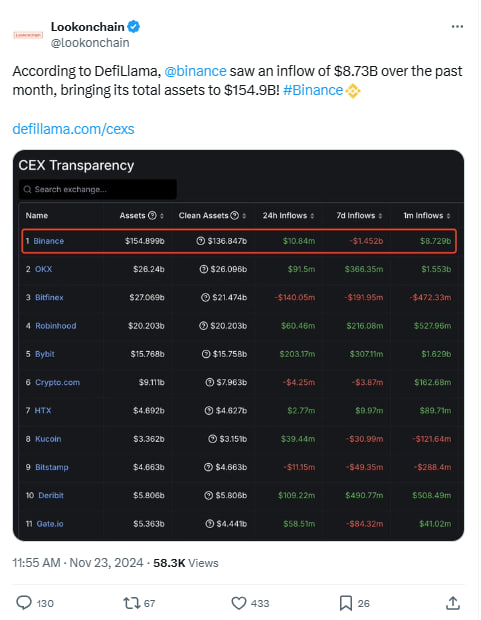

Binance Records $8.73 Billion Asset Inflows in 2024

In November 2024, Binance recorded an asset influx of $8.73 billion, elevating its complete holdings to $154.9 billion. Amid financial uncertainties, customers are transferring towards platforms that provide dependable options, with Binance reportedly attracting customers with providers like staking, crypto loans, and institutional asset administration.

Read additionally: Bitcoin Surges, CZ is Released, and Binance is Raking it in!

The firm attributes its progress to a various product lineup tailor-made to crypto buyers’ wants. Despite going through regulatory scrutiny, Binance stays a number one selection for managing digital property.

Meanwhile, analysts stay optimistic about Bitcoin’s efficiency, believing that Bitcoin might attain $500,000. This upward outlook has gained momentum from growing institutional adoption and Bitcoin’s repute as a scarce asset in excessive demand.

As of press time, Bitcoin (BTC) was priced at $97,808.07, with a buying and selling quantity of $58.52 billion. While its value has dropped 0.47% in the previous 24 hours, it exhibits a 7.93% improve over the previous week, reflecting continued investor curiosity.

Disclaimer: The info introduced in this text is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Edition isn’t chargeable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.