A deep dive into Hut 8 Mining, uncovering its usually ignored enterprise sectors. Understand its monetary efficiency, strategic initiatives and HPC/AI developments.

The following visitor publish comes from Bitcoinminingstock.io, offering complete knowledge, in-depth analysis, and analyses on Bitcoin mining shares. Originally printed on Nov. 29, 2024, it was penned by Bitcoinminingstock.io writer Cindy Feng.

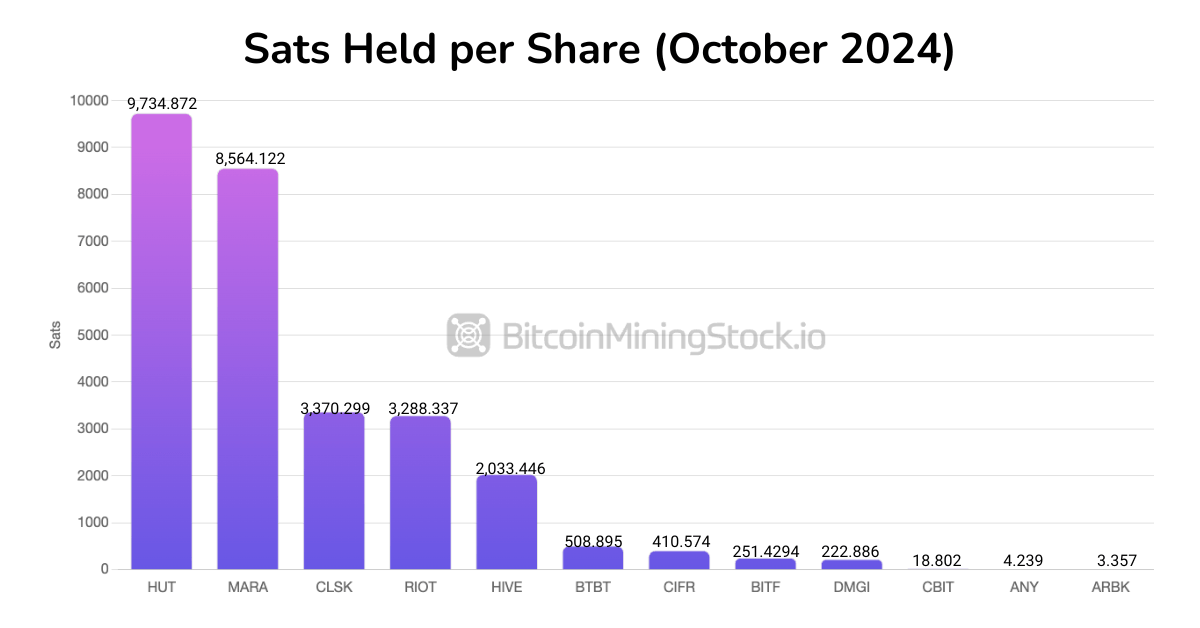

The YTD efficiency of Hut 8 Mining Corp. (NASDAQ: HUT) has made it a standout. Other metrics like Satoshi per share are additionally eye-catching, the place Hut 8 outperforms MARA and the place the latter is the biggest Bitcoin holder amongst all public Bitcoin mining firms. As one of many first Bitcoin miners to go public (initially listed on the TSX in 2018 and in a while Nasdaq in 2021) Hut 8 has skilled the complete spectrum of market cycles. By analyzing this Bitcoin mining veteran, we are able to acquire precious insights to higher navigate the ever evolving business.

Source: https://bitcoinminingstock.io/holdings

Basic Profile

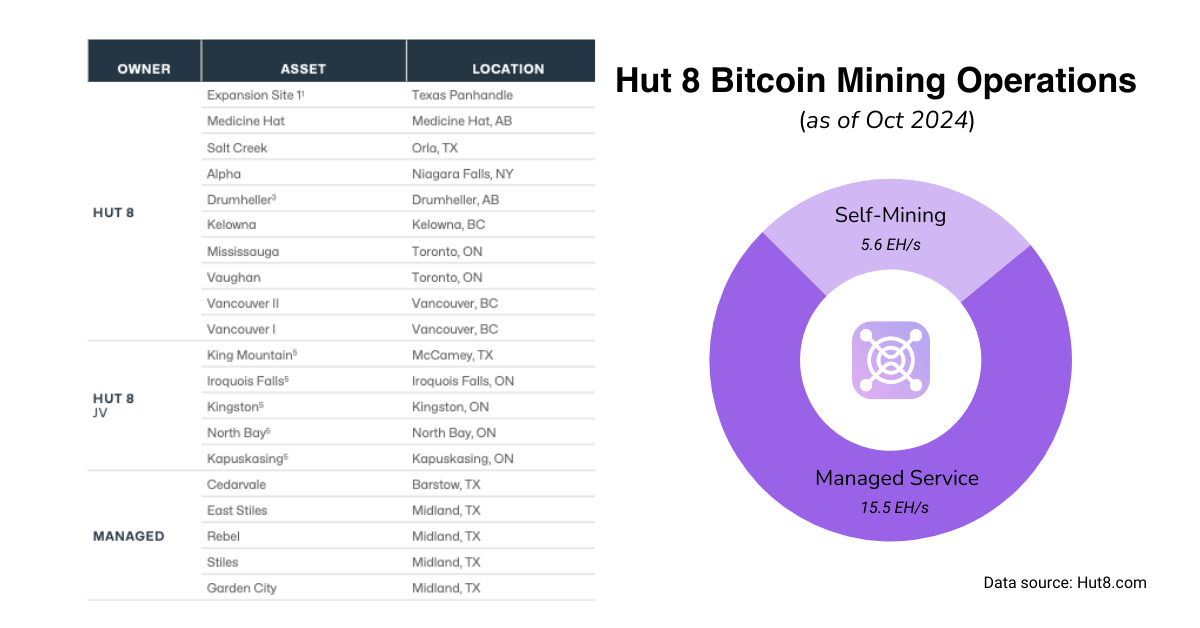

Hut 8 is a Bitcoin miner with operations in Canada and the United States. The firm at the moment has 20 websites in its portfolio, comprising each operational services and others at the moment beneath improvement. At the time of writing, Hut 8 reported a mixed capability of 967 MW, equal to 20.1 EH/s. This consists of 5.6 EH/s for self-mining, and the remaining allotted to managed companies.

Beyond its core mining operations, Hut 8 engages in Bitcoin mining tools gross sales and repairs. Additionally, the corporate’s Far North JV website participates in grid balancing packages by way of pure gasoline energy crops in Ontario, Canada.

In July, Hut 8 introduced the closing of a $150M funding from Coatue, after which launched GPU-as-a-Service in September. It’s clear that the corporate is accelerating its place within the HPC/AI sector. In latest advertising supplies, Hut 8 describes itself as an “energy infrastructure platform”, which additionally alerts a gradual transfer away from Bitcoin mining as its sole focus.

Q3 Performance

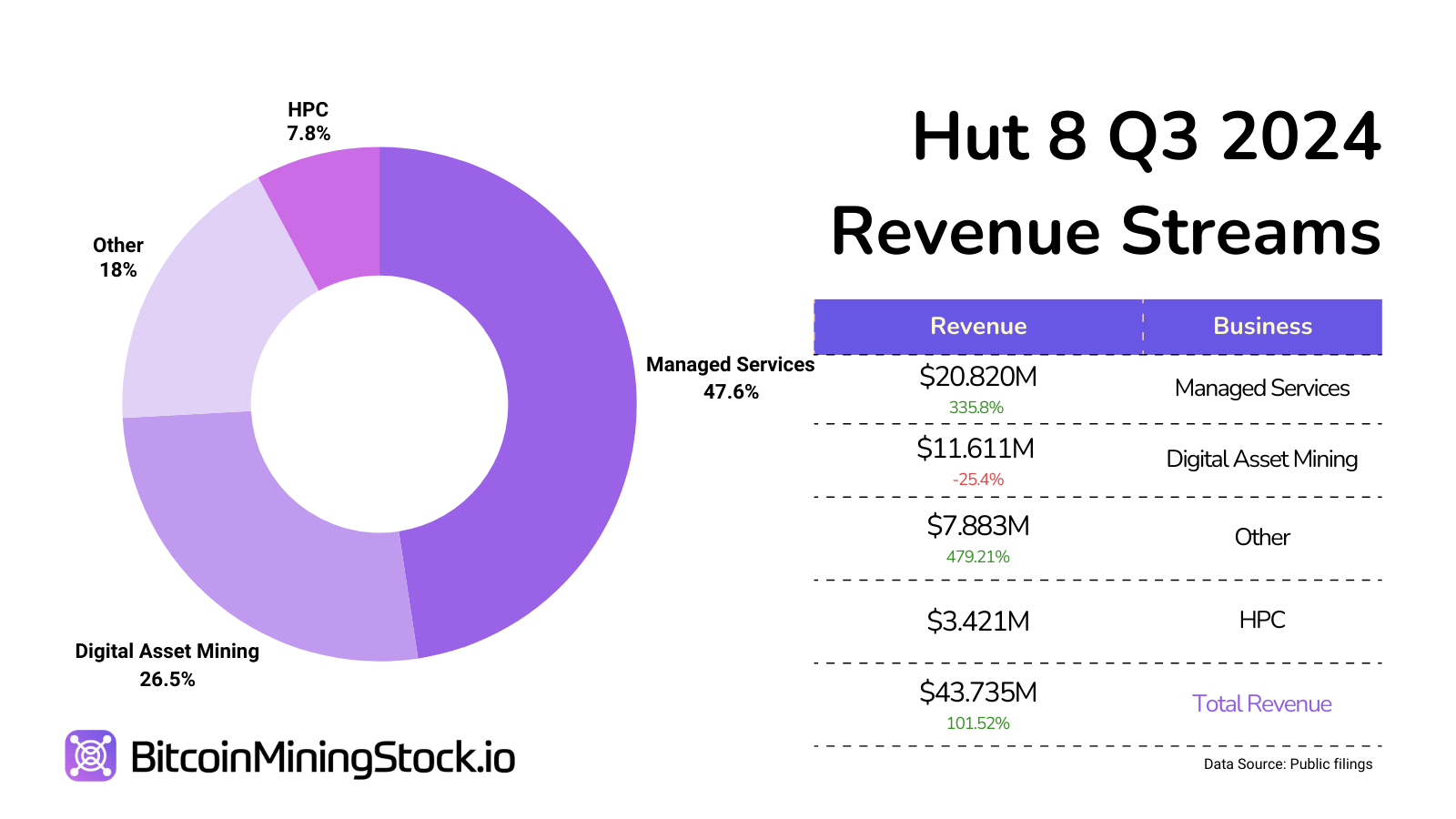

In Q3 2024, Hut 8 demonstrated sturdy income development and strategic execution pushed by diversification into HPC and energy-efficient mining.

Total income for Q3 2024 rose considerably to $43.7M, a 101% improve in comparison with the identical interval final yr (24% QoQ improve). This development was fuelled by managed companies income, which surged 336% to $20.8M, and HPC companies contributing $3.4M. Digital asset mining income nonetheless fell by 25% to $11.6M, reflecting the influence of elevated Bitcoin community problem and the April 2024 halving occasion.

Net revenue turned optimistic at $0.9M in comparison with a $4.4M loss in Q3 2023. However adjusted EBITDA fell to $5.6M, a 51% lower, pushed largely by a pointy rise in working bills. Notably, stock-based compensation alone accounted for $4.96M, a 1536% YoY improve.

On the operational entrance, Hut 8’s effectivity efforts resulted in a 33% YoY discount in power prices to $0.029 per kWh. However Bitcoin mining prices elevated to $31,482 per BTC when contemplating power prices alone, indicating areas that require additional optimization to take care of profitability.

Managed Services: Stable Recurring Revenue

Managed companies, although usually ignored by analysts, accounted for almost half of Hut 8’s whole income in Q3 and exhibited the biggest YoY development amongst all enterprise segments. These companies contain complete mission administration for patrons’ knowledge facilities together with design, development, and ongoing operation, tailor-made to the purchasers’ particular wants. Governed by long-term Project Management Agreements (PMAs) that usually span 4 to 10 years with potential renewal choices, these companies present a secure income stream.

The income from managed companies is derived from a mixture of mounted month-to-month charges, variable reimbursements, and infrequently equity-based compensation. In Q3, administration charges elevated to $4.1M from $3.4M in the identical interval final yr, whereas value reimbursements rose to $1.9M from $1.4M. Additionally, the corporate obtained $1.3M in buyer fairness and a one-time termination payment of $13.5M from MARA associated to the termination of PMAs for the Kearney and Granbury websites.

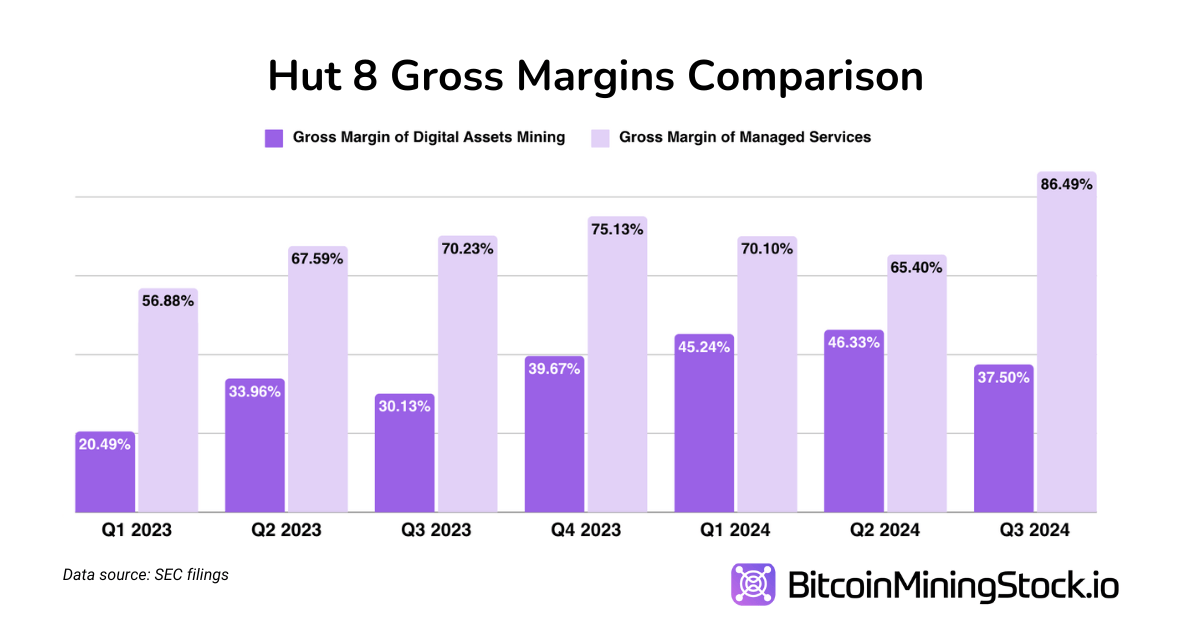

Excluding one-off revenues, the recurring revenue from managed companiesstands at roughly $6M per quarter. Not to say its round 70% of the gross margin fee. This might clarify why Hut 8 allocates almost half of its whole hashrate to managed companies. It additionally validates Hut 8’s experience in knowledge middle operations and makes the brand new model as an “energy infrastructure platform” extra convincing.

For Hut 8, the gross margins of managed companies are greater than these of Bitcoin mining, and this stays constant even after the Bitcoin Halving.

AI and HPC Ventures: Diversification with Strategic Backing

Hut 8’s HPC/AI income solely elevated by 1.66% in comparison with final quarter, however the development potential of this phase seems promising. In July the corporate secured a $150M funding from Coatue Management, a famend technology-focused funding agency with over $47B in property beneath administration. Coatue is understood for its strategic investments in GPU infrastructure and AI knowledge facilities, having backed high-profile firms resembling Tesla, ByteDance, and Stripe.

Hut 8 Joins Coatue’s AI Portfolio (screenshot from its presentation deck)

This partnership supplies Hut 8 with essential capital for deploying and scaling AI and HPC infrastructure, together with NVIDIA H100 GPUs in its GPU-as-a-Service vertical. Moreover, it grants entry to Coatue’s community of technological experience and market insights, enhancing Hut 8’s credibility and market place within the AI and HPC sectors.

The success of this enterprise will depend on Hut 8’s means to seize market share in a aggressive panorama dominated by established HPC suppliers. Regardless, Coatue’s backing alerts confidence in Hut 8’s technique, infrastructure, and execution functionality.

P.S. Hut 8’s HPC companies primarily embody colocation and cloud options. To perceive technical features, it’s possible you’ll discover this text from Digital Mining Solution useful.

Strategic Initiatives: ASIC Fleet Upgrade and BITMAIN Partnership

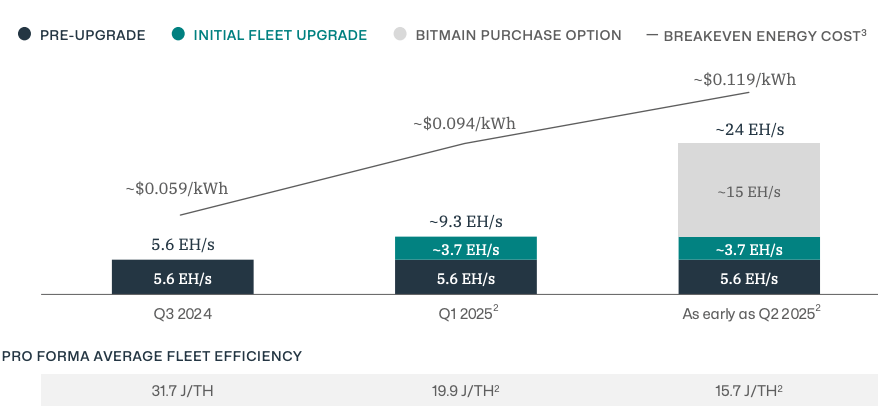

Hut 8 has undertaken important strategic initiatives to boost its mining capabilities and operational effectivity. In early November, the corporate introduced an ASIC fleet improve with the preliminary buy of 31,145 BITMAIN Antminer S21+ miners, scheduled for deployment in early 2025. This improve is predicted to spice up Hut 8’s self-mining hashrate by roughly 3.7 EH/s to a complete of 9.3 EH/s, representing a 66% improve. This will enhance power effectivity by lowering consumption by 37%, attaining an effectivity fee of 19.9 J/TH.

Hut 8 Fleet Upgrade Summary (screenshot from its Q3 Results Deck)

Earlier in September, Hut 8 entered into a 15 EH/s colocation settlement with BITMAIN at their Vega website, anticipating the deployment of next-generation U3S21EXPH miners in Q2 2025. To absolutely leverage liquid-to-chip cooling expertise, Hut 8 has developed a customized design for its Bitcoin mining knowledge middle infrastructure. Their settlement features a buy possibility, enabling Hut 8 to probably scale its self-mining hashrate to round 24 EH/s by mid-2025.

Capital Structure and Liquidity

As of Q3 2024, Hut 8 had $72.3M in money and digital asset holdings valued at $576.5M. The firm’s conversion of a $37.9M mortgage with Anchorage Digitalinto fairness improved its stability sheet by eliminating future curiosity obligations of roughly $17M over three years.

Despite this, Hut 8’s stock-based compensation rose considerably in 2024 (for the 9 months ending September 30) after reaching $16.4M—an 895.8% YoY improve in comparison with the identical interval final yr. Additionally, the corporate’s reliance on Bitcoin gross sales for liquidity ties its operational funding to market circumstances, exposing it to potential money movement volatility throughout bearish cycles.

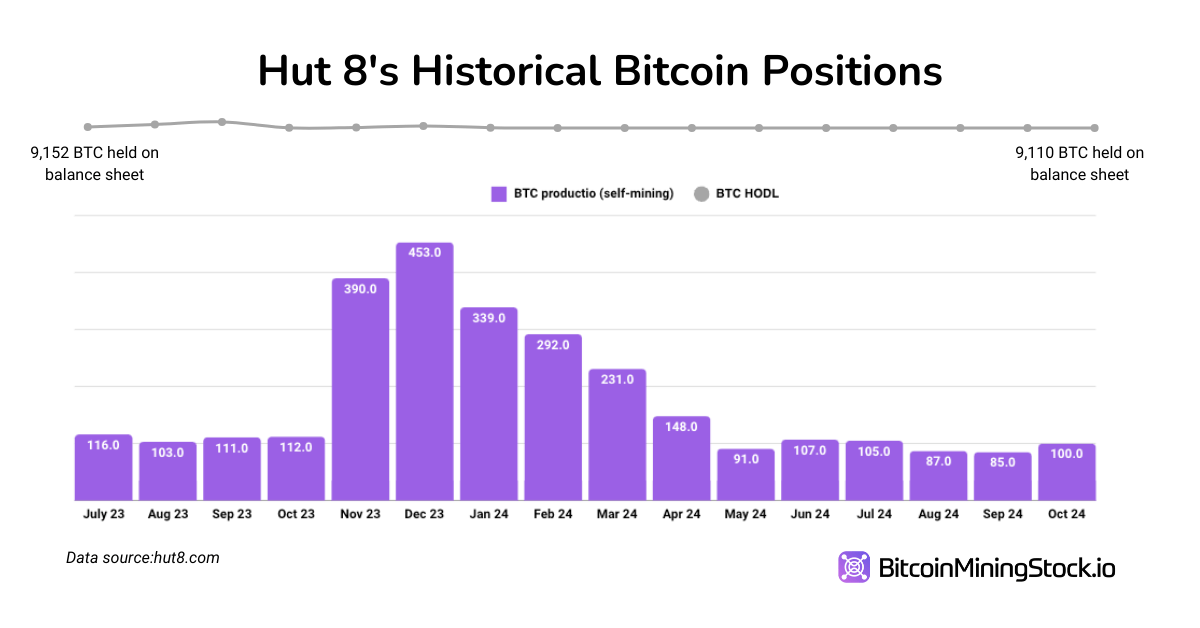

The public report of Hut 8’s Bitcoin treasury may be traced again to August 2021. Throughout 2023 and till October 2024, Hut 8’s BTC holdings remained round 9,100 BTC, indicating that the corporate has been periodically promoting newly minted Bitcoin.

Final Thoughts

Earlier this yr, investigative analysis firm J Capital Research questioned Hut 8’s acquisition of USBTC and the {qualifications} of its management. Despite these criticisms, Hut 8 has delivered measurable enhancements: from power effectivity, strategic partnerships to disciplined capital administration and traders can observe tangible modifications. This veteran Bitcoin mining firm now pivots towards changing into an power infrastructure platform with a spotlight past mining. With Coatue’s funding, its AI and HPC companies are positioned for development within the coming quarters. Personally, I really feel Hut 8 stays a compelling alternative as a result of its previous and current completely display the best way to adapt and thrive in an ever-evolving business.