Michael Saylor, the CEO of MicroStrategy, has outlined a Bitcoin strategy to place the United States as a world chief in the digital financial system.

This transfer comes as his firm expanded its Board of Directors from six to 9 members, bringing in distinguished cryptocurrency advocates to strengthen its strategic concentrate on digital belongings.

Saylor advocates for Bitcoin reserve

On December 20, Saylor defined that his imaginative and prescient revolves round implementing a Strategic Bitcoin Reserve (SBR) to deal with financial challenges, enhance greenback dominance, and create unprecedented progress alternatives in the digital asset sector:

“A strategic digital asset policy can strengthen the US dollar, neutralize the national debt and position the United States as the global leader in the 21st century digital economy, empowering millions of businesses, driving growth and creating trillions in value,” Saylor wrote in X.

Read extra: The greatest Bitcoin whales in 2024

Saylor’s proposal outlines how a strong digital asset coverage may create a renaissance in capital markets, unlocking trillions in worth. He envisions a $10 trillion digital forex market driving demand for U.S. Treasuries whereas fueling progress in digital belongings.

He additionally believes that increasing this market may enhance the valuation of the digital financial system from $1 trillion to $590 trillion, with the United States main the method:

“Establishing a Bitcoin reserve (is) capable of creating $16–81 trillion in wealth for the US Treasury (and) providing a path to offset the national debt,” Saylor stated.

Despite these daring claims, critics like enterprise capitalist Nic Carter stay skeptical. Carter argues that the SBR idea lacks readability and will destabilize markets moderately than strengthen the greenback. He factors to Bitcoin’s volatility, referencing its current worth drop from over $108,000 to $92,000, as proof that it is probably not a dependable reserve asset.

Furthermore, Carter believes that such a transfer may undermine the greenback’s international place moderately than enhance it: “I don’t support a Bitcoin Strategic Reserve, and neither should you,” Carter acknowledged.

MicroStrategy board brings crypto experience

According to a December 20 SEC submitting, the Bitcoin-focused firm’s board has elected new board members. New additions embrace Brian Brooks, former CEO of Binance US and a number one determine in crypto regulation; Jane Dietze, Chief Investment Officer at Brown University; and Gregg Winiarski, Chief Legal Officer at Fanatics Holdings.

These new board members carry numerous expertise in finance, know-how and rising markets, aligning with MicroStrategy’s broader strategic targets. Brooks, specifically, is acknowledged for his regulatory and cryptocurrency experience. He has held management roles at main crypto firms, together with Coinbase and BitFury Group, and has additionally served as Acting Comptroller of the Currency.

Read extra: Bitcoin (BTC) Price Prediction: 2024 to 2030

Meanwhile, Dietze has additionally served on the board of crypto asset administration agency Galaxy Digital. Meanwhile, Winiarski has expertise with a privately owned international digital sports activities platform. MicroStrategy is the largest publicly traded company holder of Bitcoin.

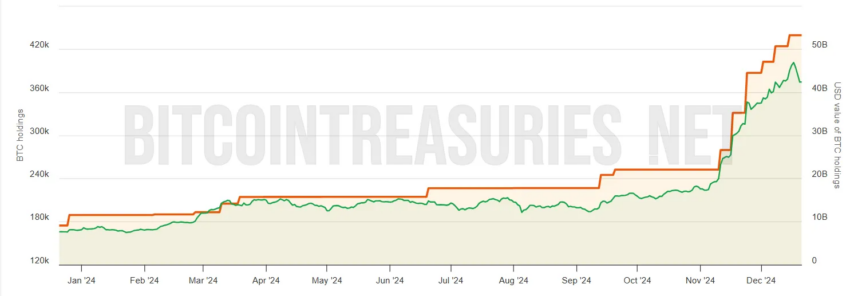

According to Bitcoin Treasuries information, the firm at present holds 439,000 BTC valued at over $43 billion.

Disclaimer

Disclaimer: In compliance with Trust Project tips, BeInCrypto is dedicated to offering unbiased and clear reporting. This information article is meant to present correct and well timed info. However, readers are suggested to independently confirm information and seek the advice of an expert earlier than making any selections primarily based on this content material.