Key Takeaways

Galaxy Digital’s direct Nasdaq listing followed a lengthy 1,320-day regulatory process.

Galaxy Digital operates primarily in crypto and AI, aiming at institutional adoption.

Share this article

Galaxy Digital, a prominent financial services and investment management firm led by billionaire Mike Novogratz, started trading on Nasdaq Friday under the ticker GLXY.

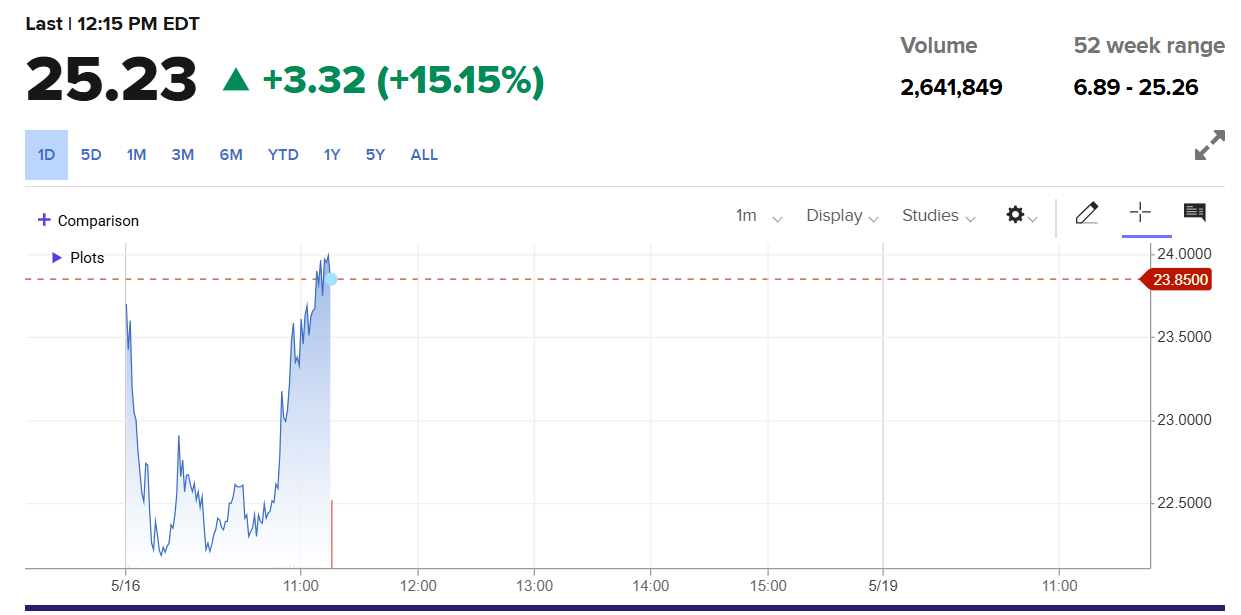

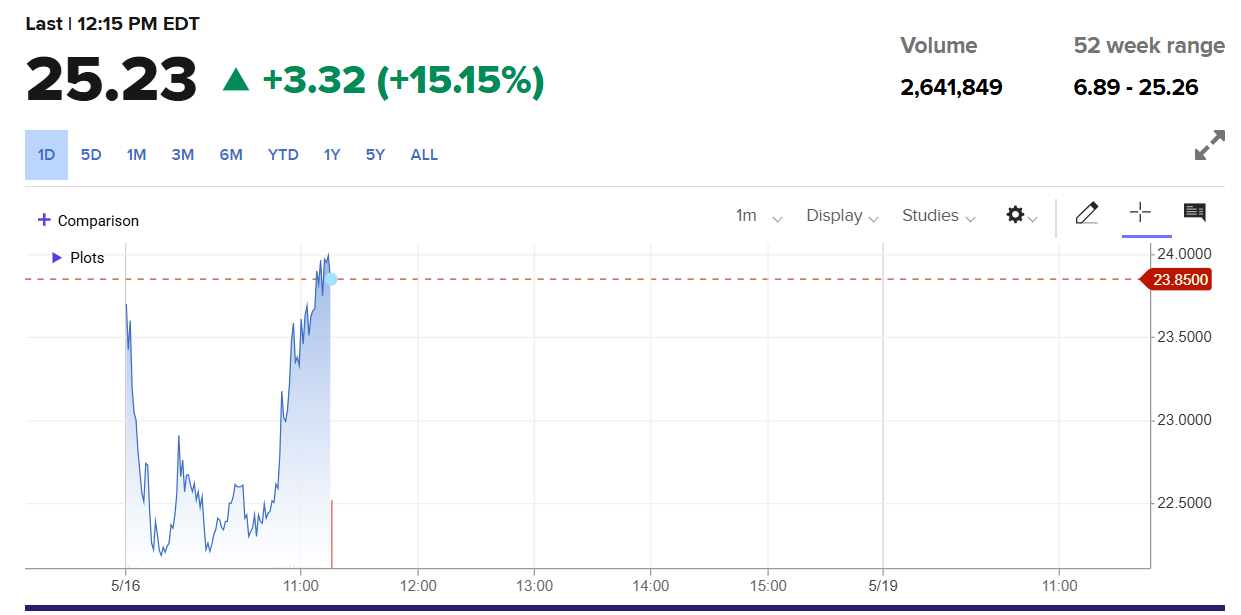

The company’s stock opened at $23.50 and surpassed $25 at press time, according to CNBC data. Shares rose about 15% from the previous trading session.

Galaxy completed its long-anticipated move from the Toronto Stock Exchange to the Nasdaq via a direct listing. The entrance into the US public market followed an extensive regulatory process with the SEC, which took 1,320 days and cost the company over $25 million, according to CEO Mike Novogratz.

“This is more than just a corporate milestone,” said Novogratz in a Friday statement. “It’s the fulfillment of a deeply personal bet I made over a decade ago that the financial system was overdue for transformation.”

Galaxy reported a net loss of $295 million in Q1 during a downturn in the crypto market. Despite the loss, the company’s gross revenue rose to $12.9 billion, marking a 38% increase from the previous quarter.

Speaking on CNBC’s Squawk Box on Friday, Galaxy Digital CEO Mike Novogratz emphasized the strategic importance of US market access, stating that the firm’s visibility in Canada was just “one-thirtieth” of what it could achieve in the United States.

Novogratz also underscored Galaxy’s dual focus on crypto and artificial intelligence, calling them “the two most exciting growth areas in markets.”

In a separate interview with Bloomberg, Novogratz revealed that Galaxy is discussing plans with the SEC to tokenize its own stock and potentially other equities. The company has engaged with the SEC’s crypto task force to explore how its shares could eventually be registered and traded on a blockchain.

The long-term vision, he said, is to enable Galaxy shares, and eventually ETFs, bonds, and traditional stocks, to be used in decentralized finance (DeFi) applications such as lending and trading.

Galaxy’s Nasdaq listing follows the successful debut of crypto platform eToro, with its shares ending the first day up 30%.

Other major players like Kraken, Circle, and Gemini are also preparing to go public in a US regulatory environment that has grown more favorable to digital assets.

Share this article