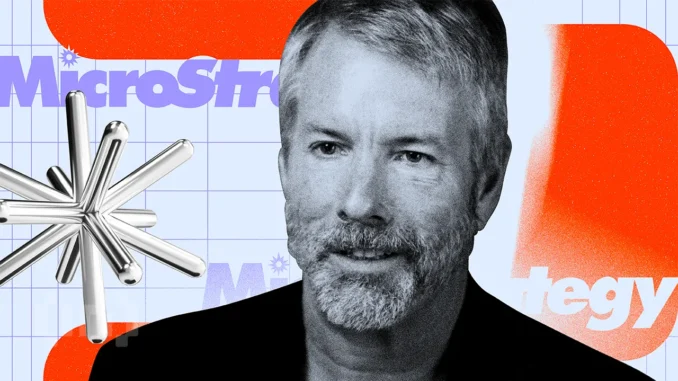

Michael Saylor, co-founder of Strategy (formerly MicroStrategy), has once again dropped a cryptic hint suggesting that his firm may soon add more Bitcoin to its already massive holdings.

In a June 22 post on X, Saylor shared a chart of Bitcoin’s performance, paired with the phrase, “Nothing Stops This Orange.”

Saylor Predicts Bitcoin Could Hit $21 Million in Two Decades

This social media post follows a familiar pattern of Saylor’s cryptic signals just before his firm files for additional Bitcoin buys with the US Securities and Exchange Commission (SEC).

Over the past weeks, Strategy’s Bitcoin position has aggressively grown following several strategic acquisitions.

This has resulted in the firm holding around 592,100 BTC, valued at over $60 billion. Strategy’s BTC reserve represents approximately 2.8% of Bitcoin’s total supply and makes it the world’s largest corporate holder of the asset.

Meanwhile, Saylor’s confidence in Bitcoin shows no signs of fading despite his firm’s substantial holding. The Bitcoin bull recently predicted that the top crypto could hit $21 million in price within the next 21 years.

“$21 million in 21 years,” Saylor said on X.

Despite the bullish tone, Saylor’s approach has drawn criticism.

Prominent investor Jim Chanos, best known for his bearish calls on companies like Enron, has publicly challenged Saylor’s claims regarding the firm’s use of debt.

In a video clip shared online, Saylor defended his strategy by saying that the company’s debt is “convertible,” “unsecured,” and “no recourse.” The Bitcoin bull also suggested that the top crypto’s value could fall 90% without impacting his firm’s repayment obligations.

However, Chanos disagreed strongly with this view, saying Strategy remains liable if the debt hasn’t converted to equity by maturity.

“There is of course recourse to Strategy if the convertible debt has not converted to equity, when due. How does he not know this?,” the investor questioned.

His criticism implies that Saylor may be overstating the safety of the firm’s debt position.

Chanos’s view is unsurprising considering his firm recently took an unusual stance of betting against Strategy while remaining long on Bitcoin.

This dual position highlights a growing view among some investors that while Bitcoin may thrive, Saylor’s aggressive corporate strategy could carry hidden risks.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.