The crypto market will witness the expiration of Bitcoin (BTC) and Ethereum (ETH) options contracts value $3.98 billion. This large expiry might affect near-term worth motion, particularly since each property have caido just lately.

With Bitcoin options valued at $3.4 billion and Ethereum at $581.57 million, the merchants They put together for potential volatility.

Bitcoin and Ethereum Options Expirations: What Should Traders Watch?

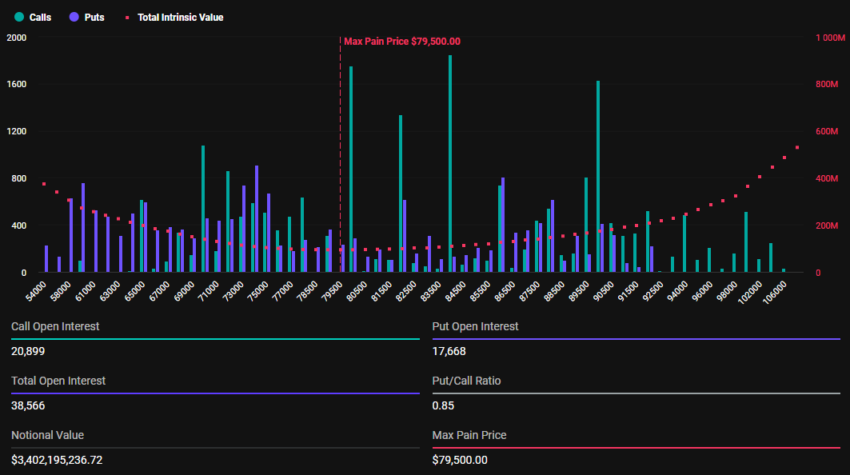

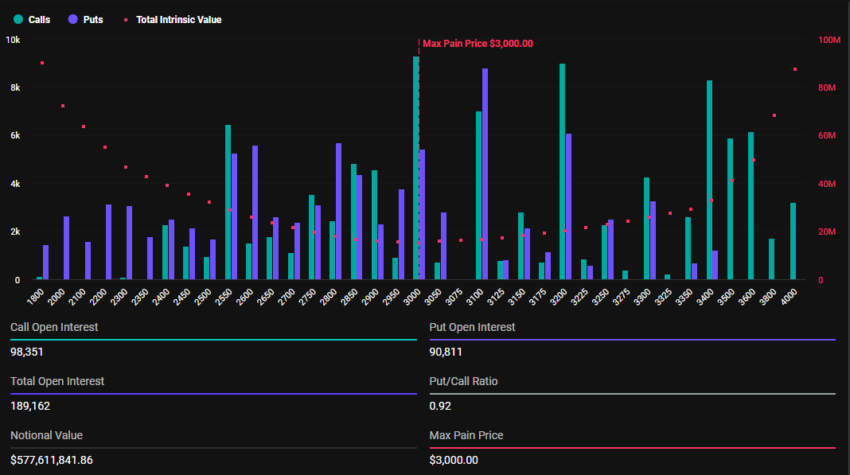

According to knowledge from Deribit, Bitcoin options expiry includes 38,566 contracts, in comparison with 48,794 contracts final week. Similarly, expiring Ethereum options complete 189,018 contracts, down from 294,380 contracts the earlier week.

For Bitcoin, expiring options have a most ache worth of $79,500 and a put/name ratio of 0.85. This signifies typically bullish sentiment regardless of the asset’s latest pullback.

In comparability, its Ethereum counterparts have a most ache worth of $3,000 and a put/name ratio of 0.92, reflecting the same market outlook.

The most ache level is an important metric that usually guides market conduct. It represents the value stage at which most options expire nugatory, inflicting most monetary “pain” on merchants.

Meanwhile, put/name ratios lower than 1 for each Bitcoin and Ethereum recommend optimism available in the market, with extra merchants betting on worth will increase.

While put options signify bets on worth decreases, name options level to bets on worth will increase. Taken collectively, this metric (put/name ratio) evaluates market sentiment.

Traders and traders ought to put together for volatilityon condition that possibility expirations typically trigger short-term worth fluctuationswhich They create uncertainty available in the market.

“The market could be very volatile, so trade with caution,” influencer Wise Advice warned.

What is anticipated going ahead?

With markets nonetheless optimistic, The common sentiment is that Bitcoin’s bullish potential stays viabledoubtlessly reaching $100,000 earlier than the top of the yr.

However, greater issues loom, with many crypto options set to expire on the finish of the month and doubtlessly much more (round $11.8 billion for BTC) on December 27.

These dates are important on condition that Bitcoin bull rallies have a tendency to finish exactly on the finish of the yr, between November and December. However, contemplating that they solely began between October and November, they’ve typically prolonged into the primary months of the brand new yr.

The expiration of those Bitcoin options on the finish of the yr might current as a significant catalyst. It might affect the instant worth motion in addition to the trajectory into the brand new yr, 2025.

With bulls viewing the year-end expiry as a novel alternative to enterprise into uncharted territory past $100,000, bears are pledging to restrict worth discovery to defend their positions.

“Looking at the options market, the market is clearly polarized and trading is very fragmented, with some of the larger traders aiming for the sky to go long, while more traders are currently on the short side of the market,” shared Greeks. .dwell.

If the positioning battle intensifies in the direction of the top of the yr, the repercussions of those options expiring might lengthen past December, setting new requirements for Bitcoin and Ethereum.

The newest knowledge reveals that the value of Bitcoin has fallen by 2.46% to $87,813. Similarly, Ethereum has fallen 5.43%, now buying and selling at $3,053.

Disclaimer

Disclaimer: In compliance with Trust Project pointers, BeInCrypto is dedicated to offering unbiased and clear reporting. This information article is meant to offer correct and well timed data. However, readers are suggested to independently confirm information and seek the advice of an expert earlier than making any selections based mostly on this content material.