Last week, a number of companies together with Citadel, Fidelity, and Charles Schwab launched the crypto trade platform EDX Markets. The aforementioned improvement was well-received by the group, for it underlined that Traditional Financial [TradFi] gamers are actually progressively backing crypto. Upon the launch, 4 belongings have been listed by the trade. Specifically, Bitcoin, Ethereum, Litecoin, and Bitcoin Cash made the minimize.

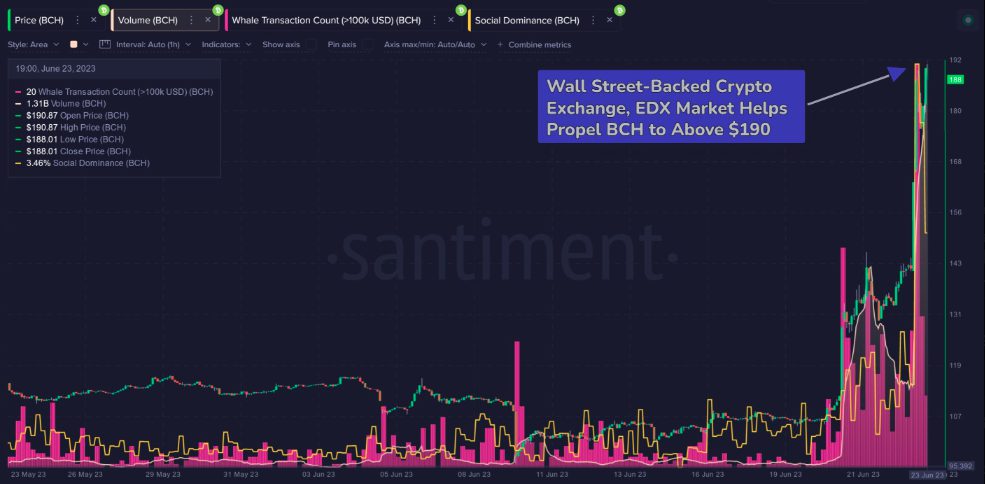

On the launch day, i.e. June 20, Bitcoin famous a 5.4% rally. The different three belongings solely inclined by 3%-3.6%. However, in the days that adopted, BCH made its rally depend. On June 21, it rallied by 23.5%, on June 23 and 24 it glided up by 36.4%, and 16.7% respectively. In impact, by the finish of the fifth day, BCH created a excessive of $222, up by greater than 111%. In the identical interval, BTC and ETH rallied by 11%-16%, whereas LTC notched up in worth by 24%.

Clearly, the EDX improvement acted like an ‘event’ for BCH. However, for the different belongings, it was principally a ‘non-event.’ With merchants’ precedence oscillating between Bitcoin, Ethereum, and different distinguished Altcoins, BCH form of turned a long-forgotten asset. However, the previous week noticed the Bitcoin-forked asset achieve a brand new life.

In truth, Santiment lately identified that BCH-related dialogue charges are at their highest degree since 2020. Alongside the three-year excessive registered on this entrance, the quantity managed to create a brand new YTD excessive, pointing in the direction of how this asset is again on merchants’ and traders’ radars.

What’s subsequent in retailer for Bitcoin Cash?

Well, on the weekly BCH remains to be the largest gainer amongst the prime 100 belongings. However, the bullish bias appeared to be truly fizzling out at press time. A day again, the asset retraced by greater than 8%, whereas immediately, it has famous a lower than 2% uptick.

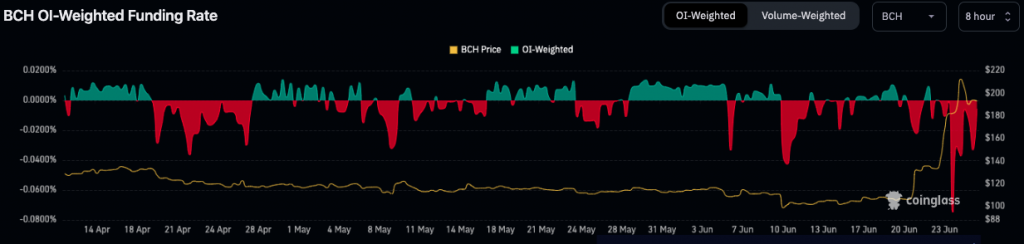

In the derivatives market, the sentiment flip was evidently seen. While the Futures OI continues to hover round a yearly excessive of $14.63 billion, it needs to be famous that the funding price is unfavorable. This means, the present market circumstances have confirmed to be fairly enticing for merchants, nonetheless, bearish merchants are prepared to pay their bullish counterparts.

Parallelly, the lengthy:quick ratio flashed a price of 0.9 at press time, re-asserting the bearish bias. So, if the present circumstances proceed to prevail, BCH would discover it difficult to proceed inclining. Thus, the odds of a pull-back transpiring over the quick time period are pretty greater at this stage.