Bitcoin mining corporations channeled a good portion of their fund raises into machine and infrastructure upgrades.

Miners Raise Big and Invest Big in Bitcoin Mining

16 publicly traded bitcoin mining corporations have raised greater than $5 billion in 2024, in keeping with theminermag.com. The report additionally revealed that Q3 had the most important property, plant, and gear (PP&E) expenditure since Q1 2022 with over $3.6 billion spent on mining upgrades.

The bulk of the PP&E spending was on modifications to mining {hardware}, together with the acquisition of recent mining websites and know-how.

This ongoing funding in {hardware} and infrastructure is in line with the surge in the Bitcoin community hashrate which measures the quantity of computing energy used for BTC mining worldwide. Despite the halving of bitcoin earlier this yr, the hashrate lately reached an all-time excessive of about 790 exahashes per second (EH/s).

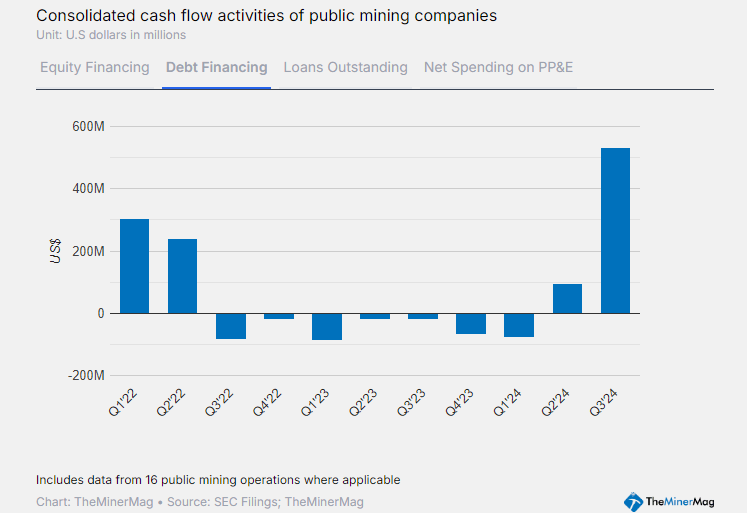

On the opposite hand, mining companies’ inventory fundraising slowed down with solely $813 million raised in Q3, down from $1.6 billion in Q2. Nonetheless, debt finance returned, as Q3 2024’s debt issuance was essentially the most since Q1 2022, with mining companies elevating $500 million.

An instance of mining corporations’ shift from fairness financing to debt financing is MARA Holdings’ latest $1 billion issuance of 0% convertible senior notes which was used to finance the acquisition of 5,771 bitcoin. Also, a notable development in 2024 is the rising emphasis on sustainable mining practices with miners searching for to steadiness profitability with environmental accountability.