- Cboe’s Filing for Ethereum ETF Options – Cboe BZX Exchange has submitted a 19b-4 filing to the SEC to list and trade options on spot Ethereum ETFs.

- NYSE American’s Similar Proposal – NYSE American also proposed Ethereum ETF options, but SEC approval is still pending.

- Expanding Investment Tools – Cboe aims to broaden investment opportunities by introducing options trading on Ethereum ETFs.

- Funds Included – The filing covers funds from Bitwise and Grayscale, including Grayscale Ethereum Trust and Mini Trust.

- Risk Management & Hedging – Cboe argues that Ethereum ETF options will help investors hedge against crypto volatility.

- SEC’s Concerns – The SEC has cited risks related to market manipulation, investor protection, and fair trading.

- Regulatory Alignment – Cboe highlights that Ethereum ETF options would follow the same rules as Bitcoin ETF options.

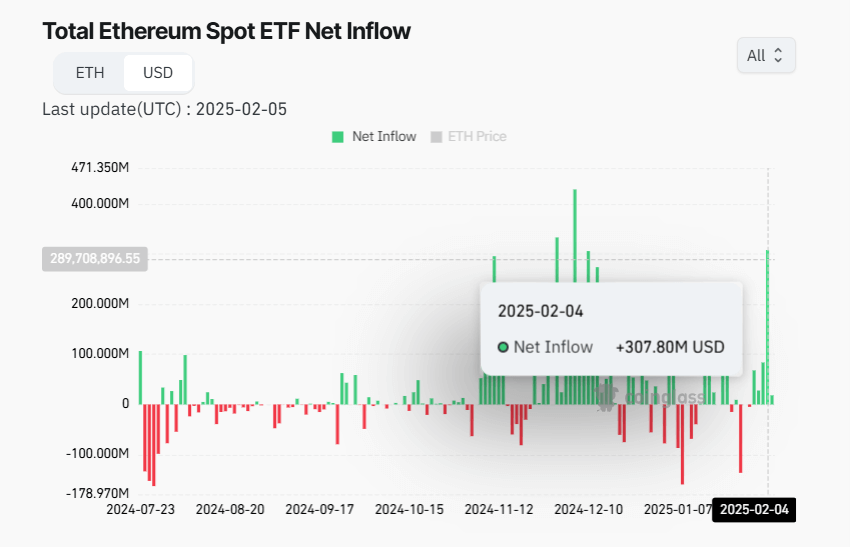

- Surge in Ethereum ETF Interest – Ethereum ETFs have seen record trading volumes, with a $307.77M inflow on Feb 4, 2025.

- Potential Market Impact – Options trading could enhance liquidity, stabilize prices, and drive institutional adoption.

- Approval Timeline – Based on Bitcoin ETF options, Ethereum ETF options could be approved in 8-9 months, possibly as early as next month.

Share this articleCategoriesTags