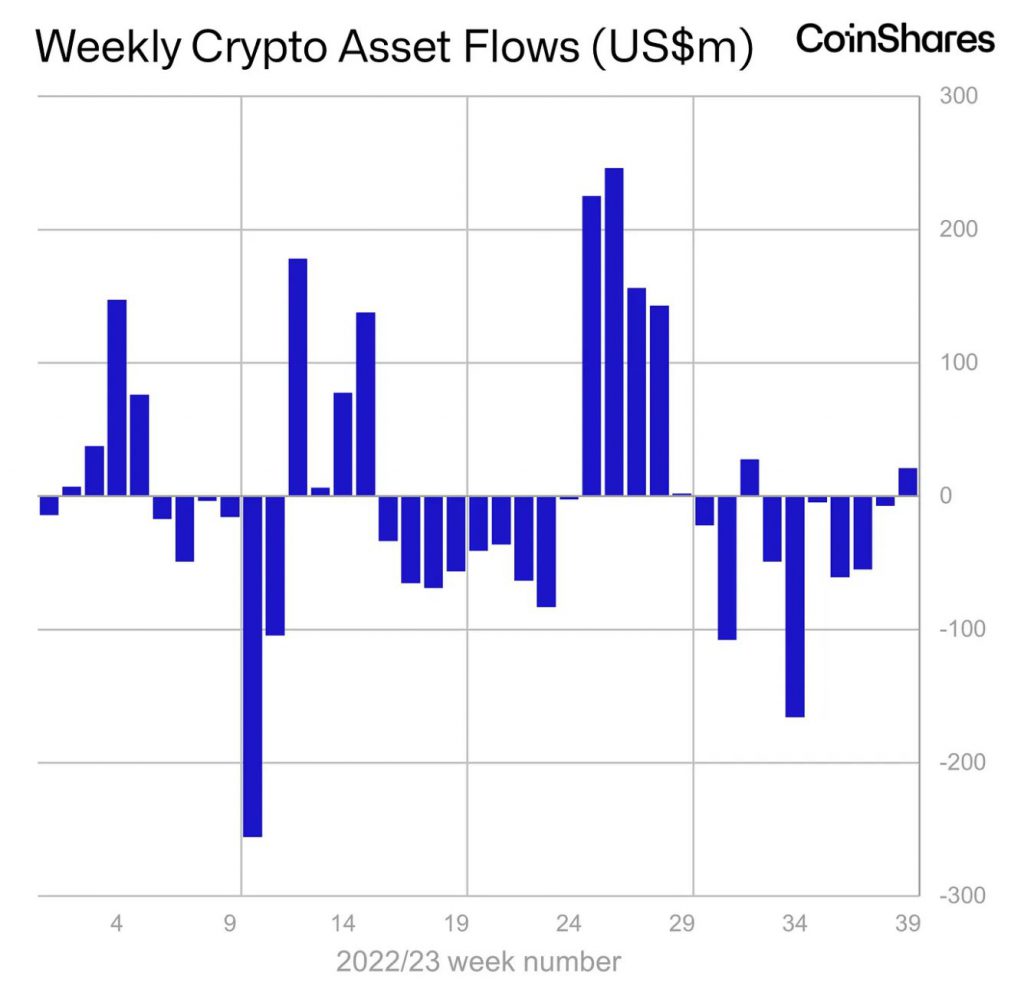

For the first time in six weeks, establishments have purchased extra crypto than the quantity offered. After registering outflows for 1.5 months, crypto asset funding merchandise registered optimistic flows for the first time final week. CoinShares’ newest weekly report highlighted that the inflows have been price round $21 million. Chalking out the motive for the development flip, the report highlighted,

“We believe the inflows are a reaction to a combination of positive price momentum, fears over U.S. government debt prices and the recent quagmire over government funding.”

Bitcoin and Solana have been the greatest beneficiaries. Bitcoin inflows summed as much as $20 million final week, whereas Solana’s quantity flashed a price of $5.1 million. The report dropped at mild,

(*6*)

Contrarily, Ethereum registered outflows for its seventh consecutive week, totalling to $1.5 million. This made the $198 billion market-capped asset, “the least loved altcoin,” in line with CoinShares.

Macro Crypto Trend

Alongside the optimistic development initiated by establishments, it’s fascinating to notice that buying energy has been creeping again into the crypto market. A latest evaluation by Sentiment revealed that the holdings of the 10 largest USDT addresses have risen from $7.30 billion to $9.42 billion over the previous three months. As far as change balances are involved, Santiment famous,

“The quantity of Tether on exchanges has picked up, growing from 17.6% to 24.7%, roughly the highest quantity of stablecoin shopping for energy in 6 months.“

September has traditionally been one in every of the worst months for Bitcoin. However, in 2023, Bitcoin managed to shut the month on a optimistic notice. A latest publish by Kaiko revealed that BTC registered one in every of its “best” September month-to-month performances since 2021. It wrapped up the month by buying and selling 4.7% increased.