Iran has confronted main energy blackouts in its capital, Tehran, and neighboring provinces all through October and November. While officers cite numerous causes, crypto mining has emerged as a major contributor to the ability disaster.

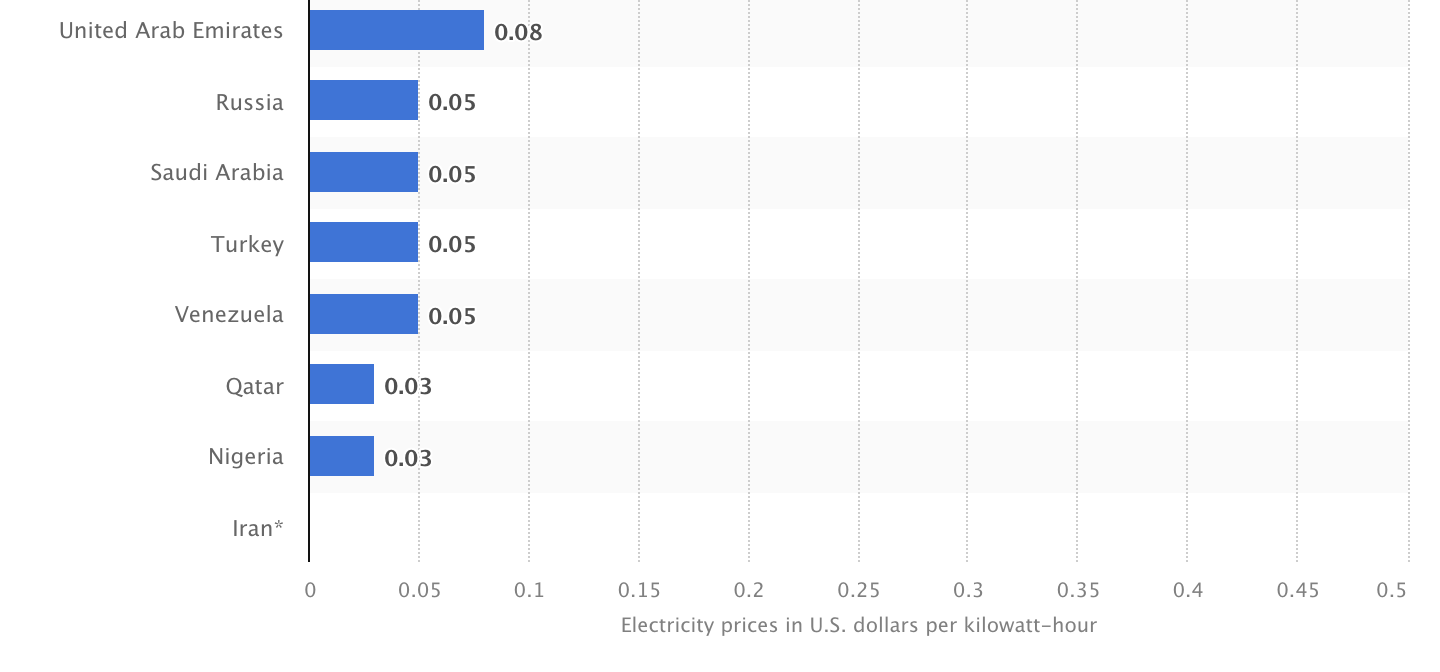

With the bottom estimated price of mining in the world, many miners exploit Iran’s closely government-subsidized electrical energy.

Iran’s Subsidized Electricity Drives Bitcoin Mining Boom

Iran’s closely sponsored electrical energy charges have made it a worldwide hotspot for Bitcoin mining since 2022. Electricity in Iran prices simply $0.002 per kilowatt-hour, the bottom in the world by an enormous margin. This low price has attracted miners, as electrical energy accounts for almost all of Bitcoin mining bills.

Lowest Electricity Prices Globally, 2024. Source: Statista.

At the time of writing, the price of mining one Bitcoin in Iran stood at $1,324, dramatically decrease than the $100,000 in the United States or $300,000 in Ireland.

In August, the CEO of Iran’s state electrical energy firm, Tavanir, highlighted the influence of unauthorized mining operations on the area’s energy grid. The energy utilized by 230,000 unlicensed gadgets is equal to the overall electrical energy demand of Markazi province, a key manufacturing hub.

In response, Tehran launched a bounty to incentivize residents to report any unlicensed crypto-mining tools.

“Opportunistic individuals have been exploiting subsidized electricity and public networks to mine cryptocurrencies without proper authorization. This unauthorized mining has led to an abnormal surge in electricity consumption, causing significant disruptions and problems within the country’s power grid,” mentioned Mostafa Rajabi Mashhadi, CEO of Tavanir, to native information.

Public frustration has grown, with Iranians sharing insights into beforehand uncovered mining farms on social media. Many of those operations are sometimes found in government-aided areas, like mosques or colleges. These institutes usually obtain discounted or free electrical energy.

Sanctions Moving Tehran Towards Crypto

Last week, the Central Bank of Iran (CBI) authorized a brand new regulatory framework for cryptocurrencies. The coverage mandates licensing for crypto brokers and custodians, guaranteeing compliance with anti-money laundering (AML) legal guidelines, counter-terrorism financing (CTF) guidelines, and tax obligations.

In latest occasions, Iran has performed a broader function in the crypto market, with geopolitical tensions typically spilling over to the business. Earlier this yr, the Israel-Iran battle had a notable influence on Bitcoin’s market worth. The tense battle again in April noticed almost $1 billion liquidated from the crypto market. However, costs recovered relatively shortly.

Also, Iran has embraced cryptocurrency as a software to mitigate financial challenges and circumvent US sanctions that limit entry to world monetary networks. The authorities has permitted regulated crypto mining to generate income and is exploring utilizing digital currencies for worldwide commerce settlements.

Although officers haven’t instantly linked Bitcoin mining to latest outages, the general public has drawn connections. Iran’s twin strategy of exploring crypto whereas combating unauthorized mining displays the sector’s complicated function in the nation’s economic system.