Japanese PM Shigeru Ishiba is tired of decreasing crypto taxes for a hard-squeezed populace, as per feedback made on Monday throughout a Q&A interval on the House of Representatives plenary session. When pressed about crypto tax reform and crypto ETFs (exchange-traded funds), the warhawk prime minister questioned whether or not folks ought to be inspired in any respect to spend money on such belongings, leading to anger from opposition events.

Citing a 2024 plan by the Financial Services Agency (FSA) to “reexamine” the subject of crypto, the chief of Japan’s Democratic Party for the People (DPP), Yuichiro Tamaki, stated on X he needs “Prime Minister Ishiba to listen to the voice of the people.”

As a public presence pushing for tax reform in Japan — the place one might be taxed an astounding 55% on cryptocurrency income (counted as miscellaneous earnings) — Tamaki is annoyed with the cold and presumptive remarks Ishiba made on Monday about taxation and ETFs (exchange-traded funds). His considerations are escalated by extra and extra folks getting into crypto in Japan, with even the FSA acknowledging it.

Ishiba uninterested, questions whether or not publish ought to even make investments

At a plenary session of the House of Representatives on Monday, Japanese PM and protection price range expansionist Shigeru Ishiba doubted whether or not folks within the land of the rising solar ought to be investing in cryptocurrencies or potential crypto ETFs in any respect.

DPP consultant Satoshi Asano broached the crypto matter with Ishiba on the session, prompting the PM to ponder (translated by Google): “Is it appropriate for the government to encourage investment in crypto assets like [they are] stocks and investment trusts, which have investor protection regulations in place? Will the public understand the application of separate taxation? There are issues that need careful consideration.”

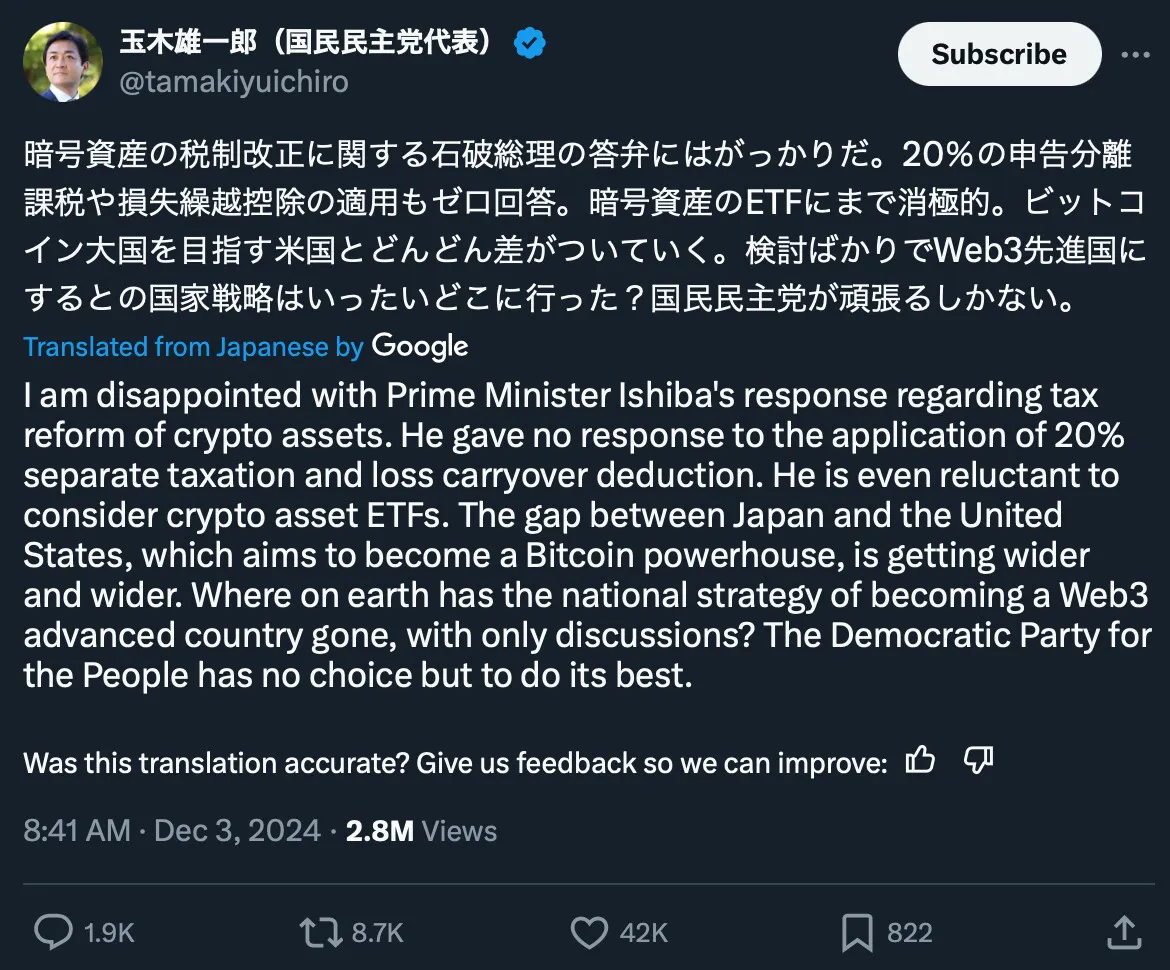

Translated feedback by the chief of Japan’s Democratic Party for the People (DPP), Yuichiro Tamaki, on X

The Democratic Party for the People and others have been pushing for a separate 20% taxation charge for cryptocurrencies. Asano identified in his query that “As the global market for crypto assets grows rapidly, the current rule that imposes a maximum 55% tax in Japan is becoming a hindrance.” He went on to notice that “Web3 companies and personal assets are flowing out of the country.”

In regard to potential Japanese crypto ETFs to compete with the likes of Blackrock and others within the US and globally, Ishiba’s remarks have been equally non-committal and even dismissive. “Whether or not to include crypto assets in ETFs needs to be considered based on whether crypto assets are assets that need to be made easier for the public to invest in,” Ishiba was quoted by native media.

DPP chief Tamaki says social gathering has ‘no choice but to do its best’

Posting on X in response to the feedback, DPP chief Yuichiro Tamaki emphasised: “The gap between Japan and the United States, which aims to become a Bitcoin powerhouse, is getting wider and wider.”

“I am disappointed with Prime Minister Ishiba’s response regarding tax reform of crypto assets. He gave no response to the application of 20% separate taxation and loss carryover deduction. He is even reluctant to consider crypto asset ETFs.”

Tamaki ended his publish on X by saying that his social gathering has “no choice but to do its best.”

Many fingers are crossed from Sapporo to Nagasaki, hoping for a greater 2025 in Japan, and for Ishiba to come back round. But at the very least one other Japanese identify in crypto, Satoshi Nakamoto, has already birthed the concept of permissionless, peer-to-peer crypto transactions that work everywhere in the globe, regardless.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.