The 2024 bitcoin halving occasion sparked main adjustments within the mining scene, in line with the most recent “State of the Network” report by Coin Metrics and analyst Matías Andrade.

Battle for Hashrate Dominance

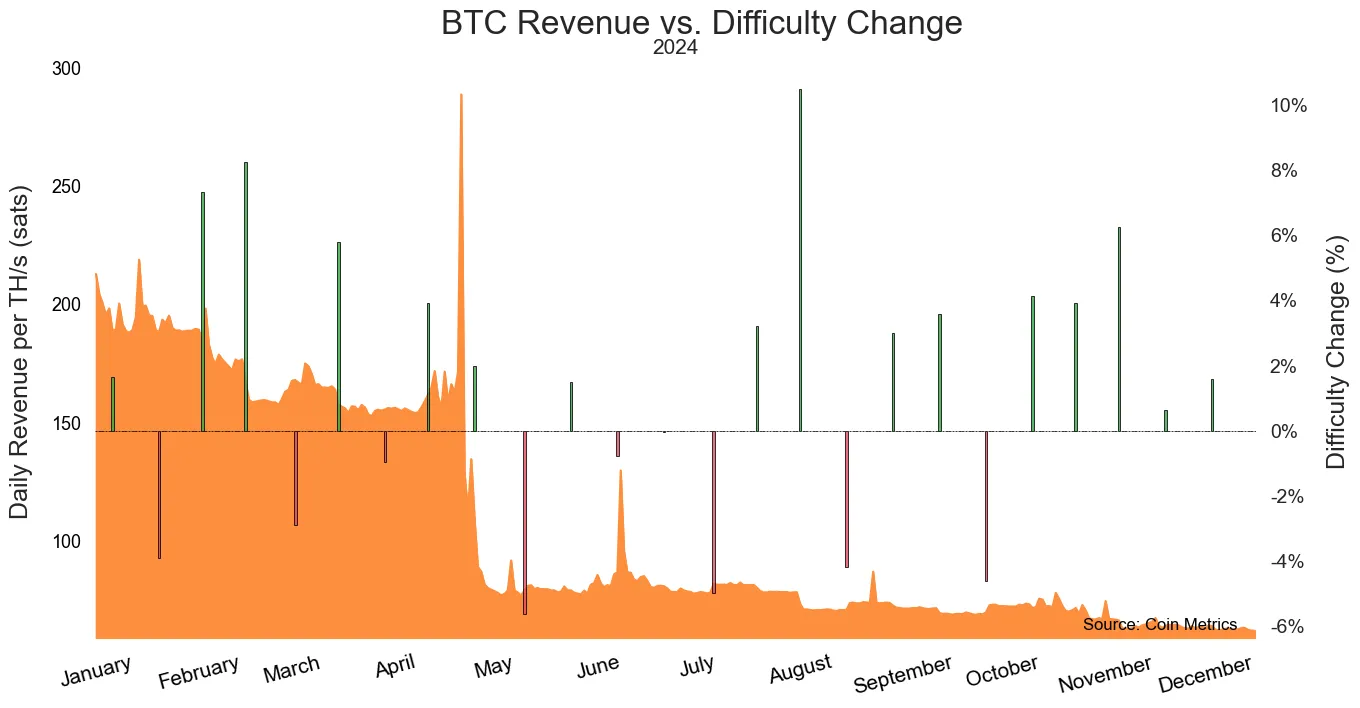

The April 2024 halving, which slashed block rewards from 6.25 BTC to three.125 BTC, severely impacted miner earnings. Coin Metrics’ new report reveals a pointy fall in BTC-denominated income per terahash per second (TH/s) of mining energy proper after the occasion.

However, an exhilarating leap in bitcoin’s worth to over the $105,000 vary cushioned a number of the blows, boosting USD-denominated income per TH/s. Even so, profitability nonetheless lags behind its pre-halving heyday, signaling powerful instances for miners attempting to maintain their revenue margins intact.

Coin Metrics’ evaluation exhibits that publicly traded bitcoin mining firms have outshone bitcoin’s worth development, with wild ups and downs. While bitcoin climbed by 54.3% since July, shares of main mining corporations soared. Hut8, Bitdeer, and Core Scientific topped the charts, gaining 68%, 78.5%, and 60.2%, respectively.

Researcher Matías Andrade highlights that operational smarts, sturdy financials, and cutting-edge mining rigs have been pivotal in distinguishing the cream from the crop. Firms that held onto bitcoin by means of the bear market additionally loved a monetary increase as BTC costs bounced again. The tech in mining {hardware} has been racing ahead.

Coin Metrics’ “MINE-MATCH” knowledge factors to a giant swap to S19-series ASICs, just like the XP and JPro fashions, which now rule the community’s hash energy. This is a transparent shift away from older fashions just like the Antminer S9, which have been largely retired by 2020. Andrade stresses that miners have to preserve their gear up-to-date to remain within the recreation on this ever-evolving mining enviornment. Looking ahead, Coin Metrics’ report stresses the significance of miners adapting to bitcoin’s dwindling provide, fine-tuning operations, and tapping into low-cost power sources.

Andrade factors out that staying revolutionary and environment friendly is essential for long-term survival as competitors heats up. The conclusion of the most recent Coin Metrics’ This fall 2024 mining report paints an image of a bitcoin mining business wrestling with income dips as a result of halving, whereas juggling {hardware} upgrades and a rollercoaster market. As bitcoin’s worth makes a comeback, the highlight is on operational toughness and tech savvy to lock in earnings.