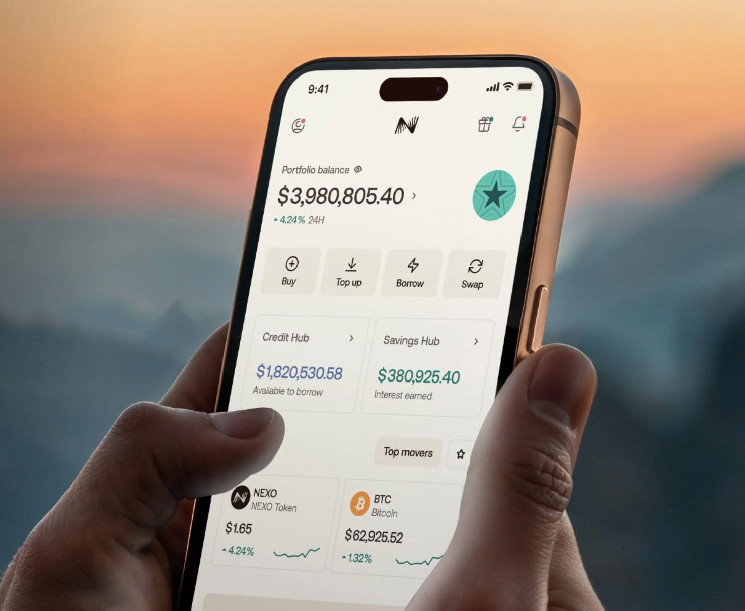

Nexo, a premier digital property wealth platform, devoted to enabling customers to develop, handle, and safeguard their cryptocurrency holdings, has launched the trade’s first Personal USD Accounts.

—

With a deal with buyer success, Nexo delivers options that create enduring worth, backed by 24/7 consumer assist. This newest innovation permits shoppers in over 150 international locations to entry USD financial institution transfers on to and from accounts in their very own names. The service, which additionally consists of EUR and GBP accounts, empowers customers with unmatched multi-currency administration in a single, unified platform.

This growth represents a serious milestone in Nexo’s mission to combine cutting-edge monetary instruments into its ecosystem. It not solely simplifies transactions but additionally strengthens Nexo’s management in creating seamless, intuitive digital wealth options.

Introducing a New Standard for USD Transfers

With Personal USD Accounts, shoppers can now prime up and withdraw funds instantly beneath their names. This providing ensures larger transparency, effectivity, and a superior person expertise, catering particularly to institutional and high-net-worth shoppers in search of simplicity and reliability in managing digital wealth.

“Nexo delivers the independence, transparency, and security that investors deserve for USD top-ups and withdrawals via bank transfers. This major milestone demonstrates the synergy between traditional finance and the digital asset space, empowering millions to experience USD bank transfers with everyday simplicity.”

Elitsa Taskova, CPO at Nexo

Nexo’s Personal USD Accounts come filled with options that set them aside from conventional banking and digital asset platforms:

Effortless Transfers: Directly ship and obtain USD with accounts held in your title, enabling sooner entry to funds.

Complete Transparency: Transactions made instantly within the consumer’s title guarantee unmatched visibility and safety.

Simplified Global Transfers: SWIFT integration allows safe, environment friendly cross-border transactions tailor-made to the wants of a globalized financial system.

Multi-Currency Management: Nexo is the primary digital asset platform providing USD, EUR, and GBP accounts in customers’ names, simplifying forex operations with a single view and simple monitoring.

Domestic Transfer Capabilities: Soon, shoppers will acquire entry to ACH and Domestic Wire transfers, additional enhancing flexibility with sooner and cost-effective choices for native transactions.

Innovating Digital Wealth Management

This growth underscores Nexo’s dedication to pushing the boundaries of digital wealth innovation. By decreasing complexities, expediting processes, and providing unparalleled performance, Nexo is setting new requirements for the maturing digital asset trade. Clients now have an enhanced, all-in-one answer for managing their monetary ecosystems, seamlessly integrating conventional and digital property.

—

About Nexo

Since its founding in 2018, Nexo has served shoppers throughout 200 jurisdictions, managing over $7 billion in property and processing $320 billion in transactions. The platform combines superior monetary instruments with a customer-centric strategy, providing high-yield financial savings accounts, crypto-backed loans, buying and selling options, and liquidity options just like the trade’s first crypto debit/bank card. With sturdy safety, sustainable operations, and a worldwide licensing framework, Nexo continues to drive innovation and prosperity within the digital finance house.

Learn extra at: nexo.com