Popular buying and selling platform Robinhood noticed substantial progress throughout its key metrics in October, with important will increase in buying and selling volumes and buyer property beneath administration.

The firm’s fairness buying and selling volumes jumped 48% to $126.4 billion in comparison with September, whereas cryptocurrency buying and selling surged 51% to $5.6 billion. Options contract buying and selling additionally confirmed robust momentum, rising 16% to 158 million contracts.

When in comparison with October 2023, the surge is much more seen: in equities volumes rose by 149% from $50.8 billion and in cryptocurrencies by 143% from $2.3 billion. The good leads to crypto market confirms information from the Q3 report. In the interval from July to September, the favored US-based firm generated $637 million in income, marking a 36% enhance.

Vlad Tenev, CEO and Co-Founder of Robinhood

Robinhood’s property beneath custody (AUC) reached $159.7 billion, marking a 5% enhance from September and a powerful 89% rise year-over-year. The platform attracted roughly 90,000 new funded clients in October, bringing its complete buyer base to 24.4 million.

“Net Deposits were $5.2 billion in October, translating to a 41% annualized growth rate relative to September 2024 AUC,” the corporate commented yesterday (Monday). Over the final twelve months, Net Deposits had been $43.2 billion, translating to an annual progress price of 51% relative to October 2023 AUC.”

Margin balances grew to $6.2 billion, up 13% from September, whereas money sweep balances elevated 4% to $25.5 billion. The firm’s securities lending income reached $19 million, displaying a 6% month-to-month enhance.

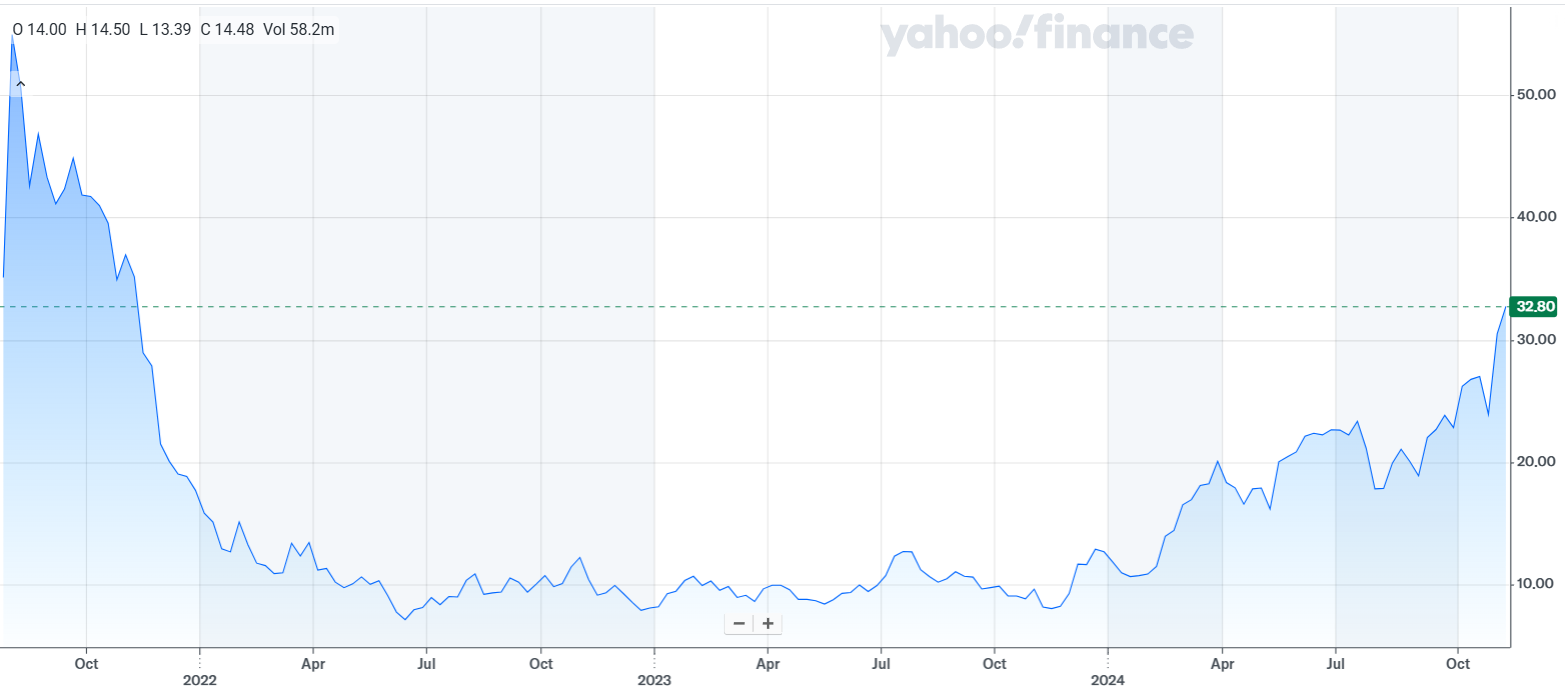

Robinhood Share Price: HOOD Tests 3-Year Highs

Following the newest report, Robinhood’s shares surged over 7% throughout Monday’s session, testing ranges above $34 per share. For the corporate listed on Nasdaq beneath the ticker HOOD, this marks the very best stage in three years.

Robinhood’s latest inventory surge is partly attributed to Bitcoin’s ascent towards the $90,000 mark, setting new all-time highs. Concurrently, Robinhood has partnered with main cryptocurrency companies to launch the Global Dollar Network, marking a big growth of its digital asset technique. This initiative, involving business leaders such as Kraken, Paxos, and Galaxy Digital, goals to problem the stablecoin market at the moment dominated by Tether and USD Coin.

The community will introduce USDG, a regulated stablecoin issued by Paxos in Singapore, with DBS Bank managing the reserve property. This transfer represents Robinhood’s most bold crypto-related enterprise since introducing cryptocurrency buying and selling to its platform.