A brand new period of inventory trading is about to unfold in 2025. The 24X National Exchange, a Stamford, Connecticut-based trading platform, is set to launch with an virtually uninterrupted schedule.

Designed to serve each retail and institutional buyers, this exchange plans to function on enterprise days from 4:00 a.m. to 7:00 p.m. Eastern Time.

But that’s not the massive deal. Pending closing approvals from the U.S. Securities and Exchange Commission (SEC), 24X may prolong operations to 8:00 p.m. ET on Sundays by 7:00 p.m. ET on Fridays—basically open for 23 hours a day with only a one-hour pause.

This is the closest the U.S. has ever come to a inventory exchange that hardly sleeps. Unlike the New York Stock Exchange (NYSE) or Nasdaq, which stick to normal hours and shut down on holidays, 24X is rewriting the foundations.

The firm is leaning into the worldwide nature of trading, wanting to accommodate markets in Asia-Pacific (APAC), the place U.S. equities are sizzling commodities, even when Wall Street is quick asleep.

Why now? – The crypto connection

Let’s not fake this can be a coincidence. Cryptocurrencies, which have been trading nonstop since Bitcoin’s debut, have been education conventional markets on what 24/7 entry appears like.

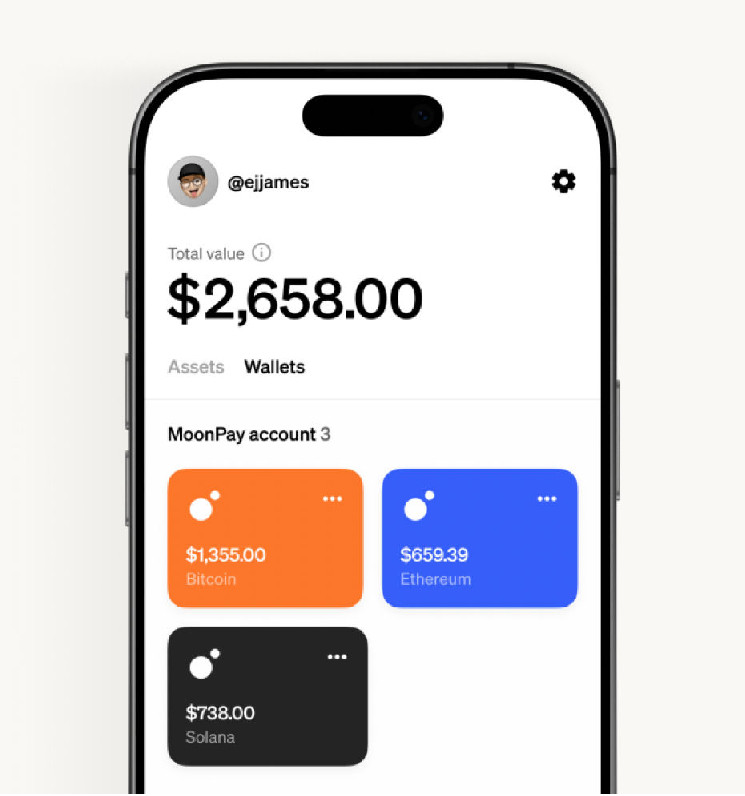

Platforms like Binance and Coinbase thrive on fixed availability, and merchants have gotten used to the concept of immediate motion, whatever the time or day.

Stocks, however, have stayed in their lane, sticking to opening bells and shutting instances. Sure, brokerage companies like Robinhood and Interactive Brokers have prolonged trading hours for some securities, however these home windows nonetheless don’t come shut to crypto’s round-the-clock hustle.

The 24X National Exchange appears to be taking a web page from the crypto playbook, recognizing the demand for seamless trading throughout time zones and asset lessons.

Dmitri Galinov, the brains behind the exchange, is aware of what’s at stake. “Traders are most at risk when the market is closed in their geographic location,” Galinov mentioned in an announcement. His answer? Bring U.S. equities trading to a world viewers and make it as accessible as crypto.

The 24X National Exchange is powered by know-how from MEMX Technologies, an organization identified for its high-performance techniques. The exchange claims it plans to use its superior infrastructure to adapt shortly to buyer suggestions, so it could possibly construct belief with merchants uninterested in inflexible techniques.

Yet, for all its ambition, 24X isn’t abandoning custom completely. The exchange will stick to U.S. market holidays, closing in sync with NYSE and Nasdaq.

An even bigger image

Traders who’ve flocked to crypto markets for his or her fixed availability may now have a compelling cause to cut up their consideration. A inventory market that’s virtually at all times open may siphon off among the quantity that’s been an indicator of crypto trading.

And let’s discuss liquidity. Extended trading hours imply extra alternatives to purchase and promote, probably stabilizing costs in each the inventory and crypto markets. But with liquidity comes volatility.

Markets that by no means actually shut are like curler coasters with out brakes. Every international occasion, every bit of breaking information, may set off reactions that ripple throughout time zones.

This isn’t nearly merchants although. Regulators will want to step up their recreation too. A near-24-hour inventory exchange is uncharted territory, and it may push the SEC to rethink how markets are overseen.

Don’t be stunned if this leads to clearer coexistence between crypto and equities. The overlap between the 2 worlds is changing into tougher to ignore.

Winners, losers, and the retail dilemma

But the reality is, not everybody might be cheering for 24X. Retail buyers, for one, may discover the concept of practically nonstop trading overwhelming. Let’s face it, not everybody has the abdomen for markets which can be at all times open, which is comprehensible.

While institutional gamers will seemingly thrive in this setting, retail merchants may wrestle to sustain, widening the hole between Wall Street professionals and Main Street novices.

There’s additionally the chance of market manipulation. Longer trading hours imply extra possibilities for dangerous actors to exploit loopholes. But for individuals who can adapt, the alternatives are enormous. Arbitrage merchants, as an example, may discover gold in the overlapping hours between shares and crypto.

Global participation may additionally see a lift, with buyers from totally different time zones leaping in when it fits them. Whether 24X succeeds or fails, it’s fairly clear that the way in which we take into consideration markets is about to change endlessly, even whether it is simply by President Donald Trump.